The post Estate Planning: The Importance of a Personal Representative in Massachusetts appeared first on McNamara & Yates P.C..

]]> In our Covid-19 driven world, it is more important than ever to complete an estate plan with an executed will, health care proxy and durable power of attorney. As most already know, a will allows you to transfer assets after your death. A health care proxy (“HCP”) gives directions to your self-selected health care agent on how to proceed in a situation where you are unable. This HCP is essential with the current pandemic because if you are unfortunate enough to be on a ventilation system in the hospital and are incapacitated, your health care agent will be making health decisions for you based on the terms in your HCP. Finally, a durable power of attorney gives authority to another individual to sign legal and bank documents on your behalf. All three of these documents should be executed when establishing a thorough estate plan.

In our Covid-19 driven world, it is more important than ever to complete an estate plan with an executed will, health care proxy and durable power of attorney. As most already know, a will allows you to transfer assets after your death. A health care proxy (“HCP”) gives directions to your self-selected health care agent on how to proceed in a situation where you are unable. This HCP is essential with the current pandemic because if you are unfortunate enough to be on a ventilation system in the hospital and are incapacitated, your health care agent will be making health decisions for you based on the terms in your HCP. Finally, a durable power of attorney gives authority to another individual to sign legal and bank documents on your behalf. All three of these documents should be executed when establishing a thorough estate plan.

In Massachusetts as of 2012, executors for your will are now called personal representatives. Even the best drafted will can lead to problems for your estate when you choose the wrong personal representative. Conversely, if you choose the right personal representative, your estate plan may benefit your loved ones and beneficiaries for generations.

The history behind the Nobel Prize is a remarkable story about an executor / personal representative. The creation of the Nobel Prize depended on the executors of Alfred Nobel’s estate.[1] In the will of the Swedish scientist Alfred Nobel, he created international prizes in 1895.[2] After Mr. Nobel invented dynamite in the 1800s, he made a huge fortune selling his invention to mining and military operations.[3]

From 1901 to present, the Nobel prize has been awarded over 570 times to over 900 different people or organizations.[4] In 1888, a French newspaper mistakenly reported that Mr. Nobel died and called him the “Merchant of Death.”[5] After Mr. Nobel read the article, it is believed that he made a final will giving over 90% of his assets to the creation of the Nobel Prize Foundation.[6] However, Mr. Nobel upset his surviving family with his final will because most of his assets were not bequeathed to them.[7]

In Mr. Nobel’s will, Ragnar Sohlman and Rudolf Lilljequist were named executors.[8] The will read: “As Executors of my testamentary dispositions, I hereby appoint Mr. Ragnar Sohlman, resident at Bofors, Vamland, and Mr. Rudolf Lilljequist, 31 Malmskillnadsgatan, Stockholm, and at Bengtsfors near Uddevalla. To compensate for their pains and attention, I grant to Mr. Ragnar Sohlman, who will presumably have to devote most time to this matter, One Hundred Thousand Crowns, and to Mr. Rudolf Lilljequist, Fifty Thousand Crowns; – Alfred Bernhard Nobel, will dated Paris, 27 November 1895.”[9]

To establish the Nobel Prize, Sohlman spent several years.[10] The will did not detail the rules for selecting award recipients.[11] As a further difficulty, Sohlman had to gather all of Mr. Nobel’s assets spread across several European countries.[12] One anecdote describes how Mr. Sohlman and Mr. Lilljequist decided to move most of Mr. Nobel’s assets to Sweden, but they feared that the French government would prevented that vast amount of money (roughly $150 million) from leaving its country.[13] As a result, the executors traveled around Paris with a horse and carriage collecting shares, bonds and legal documents of the Nobel estate. Then, the assets were shipped to Sweden on rail as registered luggage.[14]

Here, Nobel’s will is an interesting example of the application of the “dead hand.”[15] In this context, Nobel’s dead hand was an overwhelmingly huge hairy one. The creation of the Nobel Foundation is unique because the foundation acts like an investment company and is tax exempt from all taxes in Sweden and in the United States.[16] Also, the monetary award is roughly $100 thousand for the recipient.[17] Further, separate committees complete the actual selection process for the award.[18] As stated earlier, the structure and guidelines for the Nobel Prize are the creation of Mr. Sohlman and were not actually in Mr. Nobel’s will.[19] Fortunately, Mr. Sohlman was an exemplary executor who understand Nobel’s intent in his will for the creation of the Nobel prizes.[20]

Thus, one’s dead hand is only as good as his executors.[21] And in Massachusetts, the importance of the right personal representative is just as important.

[1]See The Conundrum of Alfred Nobel, National Geographic 8-11 (July/August 2017) (summarizing historic context and facts surrounding the Nobel Prize creation).

[2]Id.

[3] Evan Andrews, Did a Premature Obituary Inspire the Nobel Prize, History (Dec. 9, 2016), http://www.history.com/news/did-a-premature-obituary-inspire-the-nobel-prize [https://perma.cc/Z3QA-B434].

[4]Nobel Prize Facts, Nobelprize (Mar. 4, 2018), https://www.nobelprize.org/nobel_prizes/facts.

[5]See supra note 3.

[6]See supra note 1.

[7]Id.

[8]Id.

[9]Full Text of Alfred Nobel’s Will (Feb. 15, 2018), https://www.nobelprize.org/alfred_nobel/will/will-full.html [https://perma.cc/S73F-JF5P].

[10]See supra note 1.

[11]Id.

[12]Id.

[13]Id.

[14]Id.

[15]See, e.g., Garrett Ham, The Problem of the Dead Hand, GarrettHam (Sept. 20, 2013), https://www.garrettham.com/dead-hand/ (discussing the limitations of the deceased to control the living).

[16]See supra note 1.

[17]Id.

[18]Id.

[19]Id.

[20]See Ragnar Sohlman – Executor of the Will, Nobelprize (Mar. 5, 2018), https://www.nobelprize.org/alfred_nobel/will/sohlman.html (summarizes how Sohlman executed Nobel’s will).

[21]See Ham, supra note 15.

The post Estate Planning: The Importance of a Personal Representative in Massachusetts appeared first on McNamara & Yates P.C..

]]>

The Probate Court Is Closed, But We Can Still Prepare & File Petitions

The Probate Court Is Closed, But We Can Still Prepare & File Petitions Here’s a great development for those who seek favorable tax treatment – Massachusetts beneficiaries no longer have to pay state income tax for trusts based in other states. Sort of.

Here’s a great development for those who seek favorable tax treatment – Massachusetts beneficiaries no longer have to pay state income tax for trusts based in other states. Sort of.

Non-specialist lawyers might be forgiven for not having known these types of tax-related details. But for many Massachusetts accountants that work with clients in estate planning, this simply confirms what was already well known to those having experience in this field. In fact, that the U.S. Supreme Court even had to take up this question is an indication that expertise in the field of taxation may not be as common as it should be for many practitioners.

Non-specialist lawyers might be forgiven for not having known these types of tax-related details. But for many Massachusetts accountants that work with clients in estate planning, this simply confirms what was already well known to those having experience in this field. In fact, that the U.S. Supreme Court even had to take up this question is an indication that expertise in the field of taxation may not be as common as it should be for many practitioners. Online ordering, and Amazon’s development has led to an unpredictable but declining retail market by most accounts. Every month it seems, the news is covering a different retail chain that is struggling to maintain its customer base. Meanwhile, the advent of social media has enabled so-called “pop-up shops” to open, and begin selling in short order to already connected customers. These factors together explain in part why the pop-up shop is growing so quickly in so many retail settings.

Online ordering, and Amazon’s development has led to an unpredictable but declining retail market by most accounts. Every month it seems, the news is covering a different retail chain that is struggling to maintain its customer base. Meanwhile, the advent of social media has enabled so-called “pop-up shops” to open, and begin selling in short order to already connected customers. These factors together explain in part why the pop-up shop is growing so quickly in so many retail settings.

As the acceptance for the presence of dogs in more public areas grows, Massachusetts employers have likewise become more willing to permit dogs and other pets to come to work with their employees. And while State and local laws and regulations do impose some guidelines and restrictions in this area, the determination whether or not to allow dogs in a business depends mainly on its own internal policies. What follows are some rules and advice for Massachusetts businesses that allow or are considering allowing animals to come to work.

As the acceptance for the presence of dogs in more public areas grows, Massachusetts employers have likewise become more willing to permit dogs and other pets to come to work with their employees. And while State and local laws and regulations do impose some guidelines and restrictions in this area, the determination whether or not to allow dogs in a business depends mainly on its own internal policies. What follows are some rules and advice for Massachusetts businesses that allow or are considering allowing animals to come to work.

Perhaps more than actual laws and regulations, employers need to pay some attention to exactly how, when and why they want to allow pets in the workplace. An employee guidebook should describe the expectation that all employees maintain absolute control over their animals. Cleanliness and hygiene too should be strictly required, in order to ensure that other employees enjoy a safe and comfortable work environment. An employer should also be cognizant of informing new employees of a dog-friendly workplace policy, to avoid any conflicts from possible allergies or even a fear of certain animals. Likewise for any business that invites the public, it’s a good idea to create some signage displayed in prominent areas to inform visitors that dogs are allowed or present inside.

Perhaps more than actual laws and regulations, employers need to pay some attention to exactly how, when and why they want to allow pets in the workplace. An employee guidebook should describe the expectation that all employees maintain absolute control over their animals. Cleanliness and hygiene too should be strictly required, in order to ensure that other employees enjoy a safe and comfortable work environment. An employer should also be cognizant of informing new employees of a dog-friendly workplace policy, to avoid any conflicts from possible allergies or even a fear of certain animals. Likewise for any business that invites the public, it’s a good idea to create some signage displayed in prominent areas to inform visitors that dogs are allowed or present inside. One of the most frequent issues we deal with as estate and probate attorneys, is the problem of a fiduciary who does not honor his or her duty to beneficiaries. A fiduciary duty is a legal principle that binds the “fiduciary” to see to care for one person’s interest, typically a “beneficiary,” over and above that fiduciary’s own interest. This duty is particularly important where the fiduciary is also a co-beneficiary of an estate or trust, which is very often the case. The fiduciary titles in Massachusetts are referred to as a “personal representative” or “PR” for an estate, and “trustee” for a trust.

One of the most frequent issues we deal with as estate and probate attorneys, is the problem of a fiduciary who does not honor his or her duty to beneficiaries. A fiduciary duty is a legal principle that binds the “fiduciary” to see to care for one person’s interest, typically a “beneficiary,” over and above that fiduciary’s own interest. This duty is particularly important where the fiduciary is also a co-beneficiary of an estate or trust, which is very often the case. The fiduciary titles in Massachusetts are referred to as a “personal representative” or “PR” for an estate, and “trustee” for a trust.

When requesting items of the Trustee or PR, a beneficiary’s best strategy is to communicate the request in writing. The form may be in traditional mail or e-mail, but it’s important that the beneficiary has a record of the timing of the request. Asking the fiduciary to respond within a certain period of time is fairly typical also, which should correspond to the complexity of the request; for example a copy of the trust should be a very easy response whereas generating an account would require some time, e.g. to calculate expenses and reconcile accounts. While fiduciary duty does not require that a PR or trustee act in any fixed period of time, the beneficiary should expect a response to information requests within a reasonable timeframe.

When requesting items of the Trustee or PR, a beneficiary’s best strategy is to communicate the request in writing. The form may be in traditional mail or e-mail, but it’s important that the beneficiary has a record of the timing of the request. Asking the fiduciary to respond within a certain period of time is fairly typical also, which should correspond to the complexity of the request; for example a copy of the trust should be a very easy response whereas generating an account would require some time, e.g. to calculate expenses and reconcile accounts. While fiduciary duty does not require that a PR or trustee act in any fixed period of time, the beneficiary should expect a response to information requests within a reasonable timeframe.

It is ostensibly possible for either “primary” or “mixed use” to exist in the presence of other business types, the only difference between these licenses being revenues. The license requires very strict controls for storage and security, and also that the sales be “closely integrated with the shared business product or service.” Importantly, and probably very disappointing to many restaurateurs, these regulations explicitly forbid the use or consumption of alcohol in any of these social consumption establishments – at least at the same time marijuana is offered. Suggested businesses tailored to social consumption have included:

It is ostensibly possible for either “primary” or “mixed use” to exist in the presence of other business types, the only difference between these licenses being revenues. The license requires very strict controls for storage and security, and also that the sales be “closely integrated with the shared business product or service.” Importantly, and probably very disappointing to many restaurateurs, these regulations explicitly forbid the use or consumption of alcohol in any of these social consumption establishments – at least at the same time marijuana is offered. Suggested businesses tailored to social consumption have included: Not to be confused with consumer delivery services, these transporters will be authorized to ship marijuana between licensed establishments (think cultivator to retailer or processor, cultivator or processor to retailer etc.) Many existing operations will operate their own inter-facility shipment, but these third party licensed services will be essential for any of the smaller operators with limited resources, of which the Massachusetts licensing scheme stands to launch quite a few. Where most banks use a “Brinks” or “Loomis” shipper for their cash, it follows that a company that develops an efficient infrastructure for bulk marijuana transport in Massachusetts will be able to enjoy similar success (A little inside knowledge here, but one of our clients that reached out to Brinks learned that they would nearly give away their used vehicle inventory).

Not to be confused with consumer delivery services, these transporters will be authorized to ship marijuana between licensed establishments (think cultivator to retailer or processor, cultivator or processor to retailer etc.) Many existing operations will operate their own inter-facility shipment, but these third party licensed services will be essential for any of the smaller operators with limited resources, of which the Massachusetts licensing scheme stands to launch quite a few. Where most banks use a “Brinks” or “Loomis” shipper for their cash, it follows that a company that develops an efficient infrastructure for bulk marijuana transport in Massachusetts will be able to enjoy similar success (A little inside knowledge here, but one of our clients that reached out to Brinks learned that they would nearly give away their used vehicle inventory). Such a research facility is naturally going to materialize in the form of a non-profit, or else will likely be associated with a university, both of which Massachusetts has many —

Such a research facility is naturally going to materialize in the form of a non-profit, or else will likely be associated with a university, both of which Massachusetts has many — The draft Massachusetts “Adult Use” marijuana regulations are out, and the Cannabis Control Commission has created an ambitious market for entrepreneurs. These regulations create at least 9 distinct classes of licenses, ranging from cultivation to processing, social use and transportation, with divisions and tiers within these classes amounting to around 20 possible application types. The first applications are expected to be available in April of 2018.

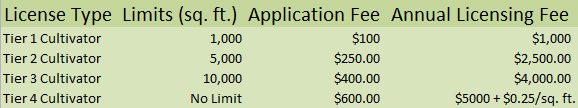

The draft Massachusetts “Adult Use” marijuana regulations are out, and the Cannabis Control Commission has created an ambitious market for entrepreneurs. These regulations create at least 9 distinct classes of licenses, ranging from cultivation to processing, social use and transportation, with divisions and tiers within these classes amounting to around 20 possible application types. The first applications are expected to be available in April of 2018.

Again, for those interested in the unique cannabinoid compounds within the marijuana plant for its many therapeutic applications, there are a number of different substances that lead to varied desirable extraction outcomes: (alcohol, butane hash oil “BHO,” water, CO2 are among the most popular). Furthermore, based on the wide variety of available delivery methods for marijuana (smoking, vaping, ingestion, sub-lingual, transdermal, topical), the number of potential products in this industry is virtually limitless. It therefore follows that the number of processors and manufacturers that participate in this market should also be limitless.

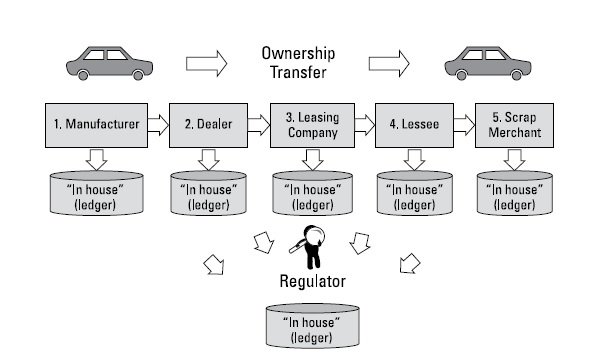

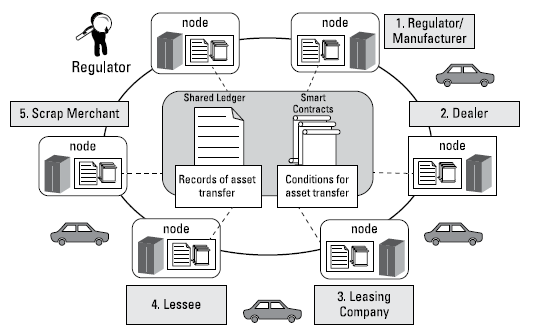

Again, for those interested in the unique cannabinoid compounds within the marijuana plant for its many therapeutic applications, there are a number of different substances that lead to varied desirable extraction outcomes: (alcohol, butane hash oil “BHO,” water, CO2 are among the most popular). Furthermore, based on the wide variety of available delivery methods for marijuana (smoking, vaping, ingestion, sub-lingual, transdermal, topical), the number of potential products in this industry is virtually limitless. It therefore follows that the number of processors and manufacturers that participate in this market should also be limitless. The future of digital “crypto” currencies like Bitcoin and Ethereum is the subject of much disagreement among technology and finance experts. But most in these fields agree that the underlying technology, called “blockchain,” will be important in a number of future applications. The reason for its growth is that blockchain is relatively immutable, secure and decentralized when compared with other database technologies. All of these characteristics are interrelated with the fact that blockchain is an encrypted distributed ledger system of executing and logging transactions. The immutability relates to its inability to be changed by any one actor, where all holders of the blockchain can independently verify the aspects of every transaction in the ledger. Its security also relates to this distribution, as well as the sophisticated levels of encryption in the blockchain and block hash etc. The benefit of being decentralized (again, the distributed ledger) means that all parties to a transaction have the same instantaneous record and do not rely on a clearinghouse, and therefore also do not depend on the service of a central party or “third party authority” (TPA).

The future of digital “crypto” currencies like Bitcoin and Ethereum is the subject of much disagreement among technology and finance experts. But most in these fields agree that the underlying technology, called “blockchain,” will be important in a number of future applications. The reason for its growth is that blockchain is relatively immutable, secure and decentralized when compared with other database technologies. All of these characteristics are interrelated with the fact that blockchain is an encrypted distributed ledger system of executing and logging transactions. The immutability relates to its inability to be changed by any one actor, where all holders of the blockchain can independently verify the aspects of every transaction in the ledger. Its security also relates to this distribution, as well as the sophisticated levels of encryption in the blockchain and block hash etc. The benefit of being decentralized (again, the distributed ledger) means that all parties to a transaction have the same instantaneous record and do not rely on a clearinghouse, and therefore also do not depend on the service of a central party or “third party authority” (TPA).