How to Set Up a Child Trust Fund With Incentives!

Families having enough financial resources that want to leave some to future generations often also want to leave their values to those same generations. Having worked hard for what they’ve earned, these families want to impart to their descendants not only the money itself, but how that money was earned. And so with this in […]

Why You Need a Health Care Proxy in Massachusetts

As part of a complete estate plan, most Massachusetts estate law attorneys will provide forms such as a “Durable Power of Attorney” and a “Healthcare Proxy.” These forms dovetail well with a last will and testament because they are documents that aim to carry out your wishes in the event you are unable to do […]

When Should I Change My Will in Massachusetts?

Most couples, whether young, middle aged, or older, need to plan on making regular changes to their estate plan. And while there is no magical number of years recommended for when to have an estate plan reviewed, most practitioners agree that every three to four years is sufficient. But there are special events in life […]

Do I Need An Attorney for a Will? | Cape Cod Estate Planning

When it comes to legal matters, let’s face it, there are many people in these economic times who are simply looking to cut costs. Absent an emergency, they reason, there is no reason to spend any more than is necessary to get the job done. So, in this line of logic, such people might consider […]

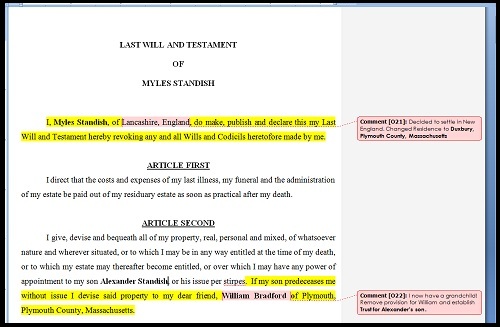

How to Write a Last Will | 10 Estate Planning Mistakes Pt. 2

Effective estate planning can seem straightforward, until you take into consideration that people and life in general can be very unpredictable. This is the second part of a two part article on common mistakes in writing a last will. To read part one click here. 1) Not Keeping Adequate Records | The Scavenger Hunt Imagine […]

Do I need a Life Insurance Trust? | 5 Reasons For an ILIT

In planning for your estate, you may have heard or researched the question of whether to place the life insurance you have or intend to purchase into a trust. While the policy itself is clearly to provide for the future financial needs of your family should you die, why would you put life insurance in […]

How to Write a Last Will | 10 Planning Mistakes Pt. 1

Effective estate planning can seem straightforward, until you take into consideration that people and life in general can be very unpredictable. Add to that the tremendous changes that can occur in a family in even so small an amount of time as a year, and the complexities begin to reveal themselves. Below are some specific […]

How to Avoid Probate | Probate Law Massachusetts

Avoiding probate is desirable, especially when trying to save money, minimize hassle, avoid delay and protect the family’s privacy. These concerns, however, must be balanced with the value of having an independent executor to divide assets among family members. A fuller explanation of these factors is described in the article “why avoid probate?” But once […]