The future of digital “crypto” currencies like Bitcoin and Ethereum is the subject of much disagreement among technology and finance experts. But most in these fields agree that the underlying technology, called “blockchain,” will be important in a number of future applications. The reason for its growth is that blockchain is relatively immutable, secure and decentralized when compared with other database technologies. All of these characteristics are interrelated with the fact that blockchain is an encrypted distributed ledger system of executing and logging transactions. The immutability relates to its inability to be changed by any one actor, where all holders of the blockchain can independently verify the aspects of every transaction in the ledger. Its security also relates to this distribution, as well as the sophisticated levels of encryption in the blockchain and block hash etc. The benefit of being decentralized (again, the distributed ledger) means that all parties to a transaction have the same instantaneous record and do not rely on a clearinghouse, and therefore also do not depend on the service of a central party or “third party authority” (TPA).

The future of digital “crypto” currencies like Bitcoin and Ethereum is the subject of much disagreement among technology and finance experts. But most in these fields agree that the underlying technology, called “blockchain,” will be important in a number of future applications. The reason for its growth is that blockchain is relatively immutable, secure and decentralized when compared with other database technologies. All of these characteristics are interrelated with the fact that blockchain is an encrypted distributed ledger system of executing and logging transactions. The immutability relates to its inability to be changed by any one actor, where all holders of the blockchain can independently verify the aspects of every transaction in the ledger. Its security also relates to this distribution, as well as the sophisticated levels of encryption in the blockchain and block hash etc. The benefit of being decentralized (again, the distributed ledger) means that all parties to a transaction have the same instantaneous record and do not rely on a clearinghouse, and therefore also do not depend on the service of a central party or “third party authority” (TPA).

Massachusetts Businesses Disrupted by Blockchain – The Legal Field

Law is easily one of the most obvious industries subject to change first under blockchain technologies. One need only look at the examples that are often used to explain the blockchain’s utility to understand why. Below are two diagrams featured in the guide “Blockchain for Dummies” offered by IBM:

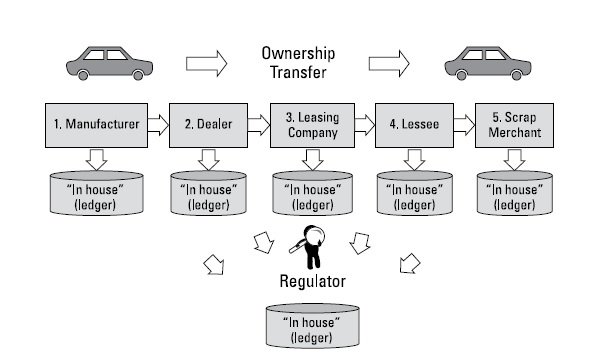

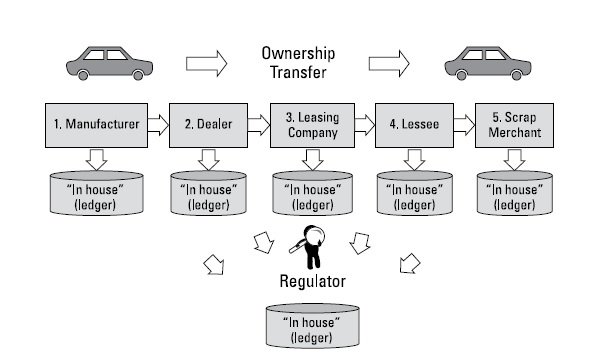

The first diagram indicates the way we presently manage automobiles, from their creation to their financing and finally their destruction. The parties to these transactions need to coordinate and exchange several aspects of the automobile throughout its lifetime, and all of these parties keep their own individual transfer records. A great deal of time and money goes into these records, the titling and registration of an automobile, especially where financing is involved. Additionally, each party in these processes must add the extra step of reconciling its own recordkeeping system with the records of every other party.

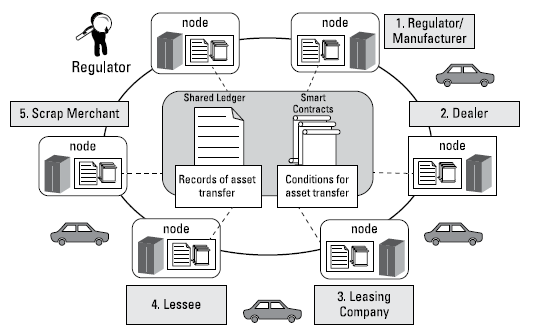

The second diagram explains why blockchain technology will eliminate much of this so-called “friction” in the transfer process. Through the shared or distributed ledger, every party holds the same instantaneous record when each transfer occurs. And rather than the necessity for each party to create its own contracts detailing the transfer process, the necessary conditions for fulfilment, and the infrastructure to communicate and execute these conditions and processes (i.e., legal work), the blockchain handles all of this.

How Blockchain Will Revolutionize the Massachusetts Insurance Industry

This new useful tool in the transmission, receipt and storage of information looms large over all aspects of the insurance industry; from insurance brokerage, to underwriting, to assessment and the claims process. So much of this information-based industry, that requires trust on the one hand, and an exchange of private data on the other, stands to see massive changes in the next 5-10 years. The creator of Ethereum himself, Vitalik Buterin, used crop insurance as an example in his whitepaper:

One can easily make a financial derivatives contract but using a data feed of the weather instead of any price index. If a farmer in Iowa purchases a derivative that pays out inversely based on the precipitation in Iowa, then if there is a drought, the farmer will automatically receive money and if there is enough rain the farmer will be happy because their crops would do well.

Vitalik’s example is a type of “parametric insurance” that can payout automatically based on independent and objective measures, rather than through the process around and interpretation of, a claims adjuster. It is easy to see the time and money saved here. To take the example one step further, the smart contract we’re imagining could even scale payouts based on the severity of the measure, for example ranging a 20% policy payout for minimal drought through 100% payout for a major one.

Another development in the industry is peer to peer insurance, much in the way that crowdfunding recharacterized mass investment models, that may drastically change the structure of the entire industry. As its name implies, the P2P insurance model uses a secure blockchain medium to link with a group of mutual “peer” policyholders as underwriters directly, thereby reducing the present layered profitmaking model with administrative and commission fees. A group of peers can theoretically come together to arrive at a consensus of the conditions on the blockchain that would trigger a payout, and determine how much such a payout would be.

Technology Efficiencies Carry Their Own Risks

For all of its promise, and as much as consumers may be ready to turn their demand for professional services to more technological solutions, the benefits of block chain also create their own risks. In today’s very hackable world, it isn’t extraordinary to imagine for example the hacking of a weather data feed to trigger policy payouts. Protections, checks and balances can be put in place to significantly protect against these risks, but the threat is still real. Regulations too, will slow the growth of smart contracts until a reliable model is proven.

Professionals and consumers alike should nevertheless continue to learn about the potential effects of blockchain on our businesses and lives in general, as these applications are being developed exponentially. The practice of law and insurance may be the first industries, to feel blockchain’s effects, but startups are using the technology in hundreds of fields ranging from energy to music. To learn more about how the blockchain and cryptocurrency business can benefit your life, call our office to contact a Massachusetts blockchain attorney. McNamara & Yates is an enterprise level cryptocurrency exchange service provider.